USD II: The Gasless Stablecoin for Gifting Crypto in 2025

Back to articles

Giving cryptocurrency like Ethereum or Bitcoin may sound simple, but in practice, it’s complicated.

You have to choose a secure crypto wallet, account for transaction fees, and make sure the recipient can access and safely store the crypto. There’s also the issue of price volatility—your gift could lose value before it’s even opened. For people new to the cryptocurrency market, that’s a steep learning curve.

This is why stablecoins—especially fiat-backed stablecoins like USD II—are changing how crypto gifting works.

What Are Stablecoins?

Stablecoins are a class of cryptocurrencies designed to maintain a consistent value, often pegged to fiat currency like the U.S. dollar. Their core benefit is price stability, which makes them ideal for everyday transactions, financial services, and gifting.

Unlike volatile cryptocurrencies such as Bitcoin, stablecoins serve as a reliable medium of exchange that avoids rapid price fluctuations.

Types of Stablecoins

These are pegged to traditional currencies and backed by reserves held by trusted custodians. They dominate the stablecoin market and are used for gifting, payments, and cross-border payment.

These use other crypto assets (like ETH) as collateral. They’re often overcollateralized to reduce volatility risks.

These are tied to physical assets like gold. Investors often use them to retain stability while diversifying into commodities.

These use smart contracts to expand or contract supply based on demand. However, as seen with TerraUSD’s collapse, algorithmic stablecoins can carry major potential risks.

These adjust value based on inflation or cost-of-living indexes instead of fiat. They help protect long-term purchasing power for crypto users.

Why USD II Is Perfect for Gifting

USD II is a fiat-backed stablecoin created by Burner and issued on the Base network. It’s backed 1:1 by U.S. dollars and treasury reserves, held by our financial partner, Bridge, and securely stored in a Privy-managed account.

Key Benefits of USD II:

- Gasless Gifting: Burner covers transaction fees on all USD II transfers through BurnerOS.

- Redeemable Anytime: Soon you will be able to redeem USD II for fiat dollars through Bridge (KYC required; fees may apply).

- Ready to Spend IRL: Soon you will be able to use USD II at Flexa-enabled merchants across the U.S.

- Secure by Design: Gifting happens through Burner Wallet, a physical card using secure chips and a browser-based interface. No need to download apps or write down seed phrases.

Stablecoin Adoption Is Growing Fast

- Emerging Markets: In Latin America and Sub-Saharan Africa, stablecoins are helping people avoid inflation and use stable digital currency for international payments.

- Institutional Adoption: In the U.S. and EU, stablecoins are powering financial instruments, settlements, and business-to-business payments.

- Everyday Use: Stablecoins now account for over two-thirds of crypto transactions globally. Their role as a medium of exchange is replacing speculative use in favor of practical financial services.

Why Burner + USD II Are Better Together

Burner Wallet makes gifting USD II fast and frictionless.

- No setup, no apps, no seed phrases

- Just tap the Burner card on a phone to access BurnerOS

- Gifting crypto becomes as easy as handing over a prepaid card but with the benefit of hardware security

- Burner supports stable digital assets, like USD II—ideal for consistent value delivery

Together, they solve key barriers around complexity, crypto taxes, and regulatory uncertainty—without exposing recipients to capital gains tax, capital loss, or taxable income surprises (though users should always consult a tax advisor).

Final Thoughts

Stablecoins like USD II are redefining how we think about gifting and transferring digital assets. With zero gas fees, built-in stability, and direct wallet access, USD II paired with Burner Wallet makes crypto gifting feel more like sending a prepaid card—and less like configuring a blockchain. Ready to make your next crypto gift secure, stylish, and simple?

FAQ: USD II and Stablecoin Gifting in 2025

❓ What makes USD II different from other stablecoins?

USD II is gasless, redeemable, and integrated into the Burner Wallet ecosystem. It’s optimized specifically for gifting, unlike more generic USD Coin or USDT implementations.

❓ Is USD II a fiat-backed stablecoin?

Yes. USD II is a fiat-collateralized stablecoin backed 1:1 by U.S. dollar and treasury reserves. It is considered part of the fiat-backed stablecoin class and can be redeemed for fiat currency.

❓ Is gifting USD II taxable?

In many jurisdictions like the U.S., gifting under the annual gift tax exclusion isn’t a taxable transaction, but recipients may face capital gains or taxable income obligations if they later convert or sell the asset. Always check with a tax advisor.

❓ What kind of wallet is Burner?

Burner is a physical card wallet that uses secure chips—similar to those in Ledger and Trezor—to provide advanced hardware-level security without complex setups or seed phrases. It pairs affordability and simplicity with a browser-based interface, making everyday Ethereum transactions easy, accessible, and secure.

❓ Can USD II be used for other purposes?

Yes. It works for everyday transactions, cross-border payment, saving, or as a digital representation of fiat currency. It’s versatile, secure, and easy to redeem.

❓ Who is Bridge?

Bridge is a financial technology platform that provides infrastructure for stablecoin issuance and management. It enables seamless conversion between fiat currencies and stablecoins, simplifying cross-border payments and digital asset management. Bridge is our financial partner holding USD II’s reserves and facilitating redemption into U.S. dollars.

❓ Who is Privy?

Privy is a secure user authentication and data management platform. It powers account creation and access for USD II by storing account data in encrypted, non-custodial containers.

❓ What is Flexa and how does it work?

Flexa is a digital payments network that allows merchants to accept crypto payments easily. Customers can spend cryptocurrencies, including stablecoins like USD II, at Flexa-enabled merchants. Flexa instantly converts crypto payments into the merchant’s local currency, simplifying transactions without additional complexity.

Get your Burner

What to read next

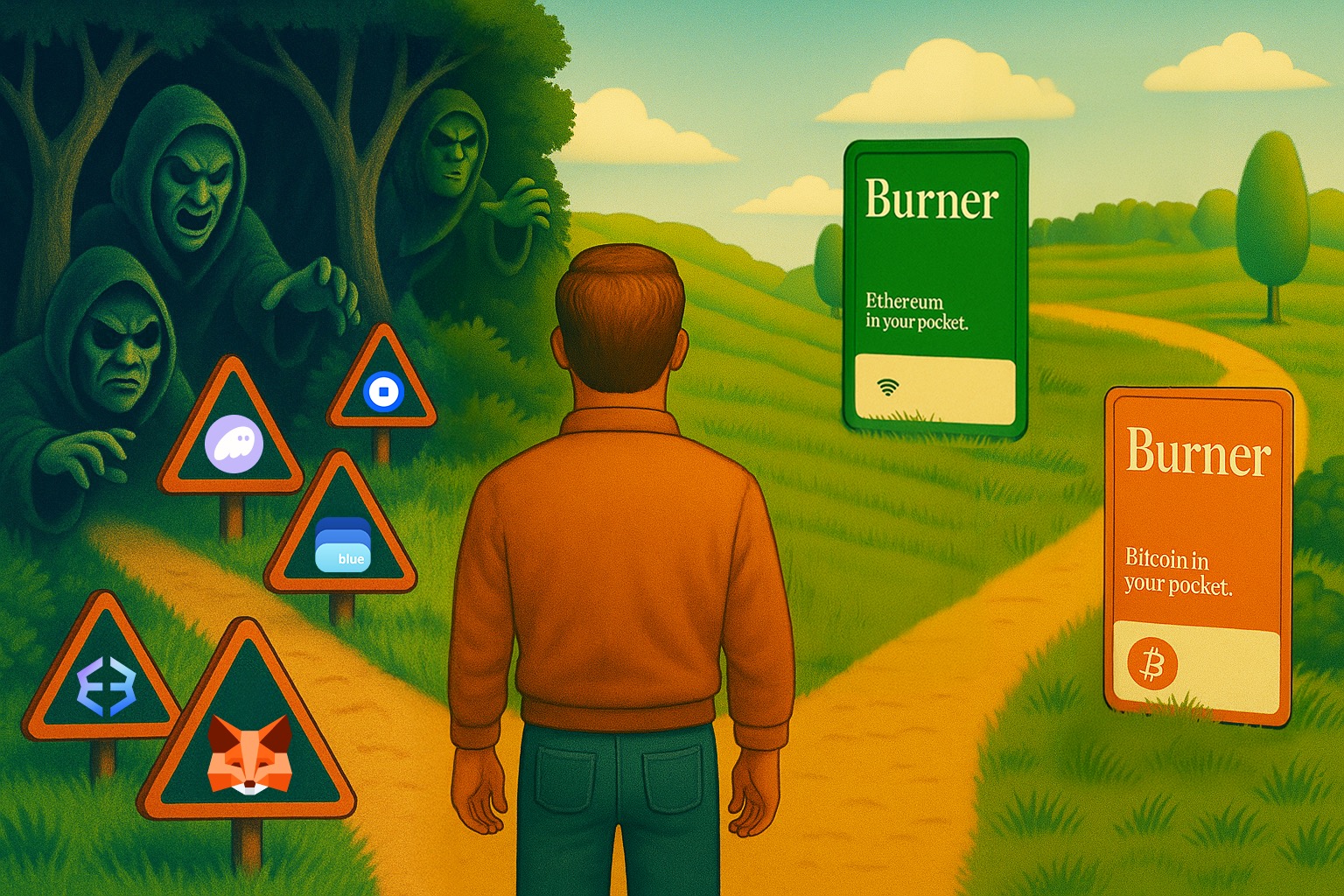

Back to articlesThe 10 Best Wallets for Onboarding to Base in 2025

Navigating wallets for the Base network doesn’t need to feel overwhelming. This guide simplifies your choice by comparing the best crypto wallets for onboarding to Base in 2025, including mobile apps, browser extensions, and the simple, secure solution of Burner Wallet and USD II, built for everyday use.

Top Stablecoins of 2025: An Investor's Guide

Looking to strike the right balance in your crypto portfolio? Stablecoins are making it easier than ever for investors to manage risk, move funds, and earn yield—without the price swings of traditional cryptocurrencies. This guide breaks down the top stablecoins on Ethereum and Base, compares features, and highlights practical use cases like payments, gifting, and DeFi. Discover which stablecoins offer the stability, flexibility, and balance you need for 2025.

Your Crypto Software Wallet’s Dirty Little Secret: It’s Not That Secure

Burner Wallet is a secure, PIN-based hardware wallet designed to make crypto gifting and management simple, safe, and affordable. Unlike traditional wallets that rely on recovery phrases, Burner uses secure chip technology to protect digital assets without the hassle. This guide explores the risks of software wallets, the benefits of hardware security, and why Burner is the best choice for anyone looking to protect or gift crypto without compromising ease of use.